The Power of Budgeting: Take Control of Your Finances Today!

Introduction

In today’s fast-paced world, managing finances can often feel like navigating through a maze blindfolded. With expenses popping up left and right, it’s easy to lose sight of your financial goals and feel overwhelmed by the constant juggling act of bills and savings.

However, there’s a beacon of hope amidst this chaos: budgeting. In this blog post, we’ll delve into the transformative power of budgeting and how it can empower you to take control of your finances and pave the way toward a brighter financial future.

Understanding Budgeting

While the word “budget” may conjure images of restriction and deprivation, in reality, it’s a tool that grants you freedom and flexibility.

By knowing exactly where your money is going, you can make informed decisions, prioritize your spending, and ensure that you’re living within your means.

Setting Financial Goals

Whether you’re aiming to build an emergency fund, save for a dream vacation, or pay off debt, a well-crafted budget can help you get there faster.

By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, you can give your budget purpose and direction, transforming it from a mere tool into a strategic financial plan.

Practical Tips for Budgeting Success:

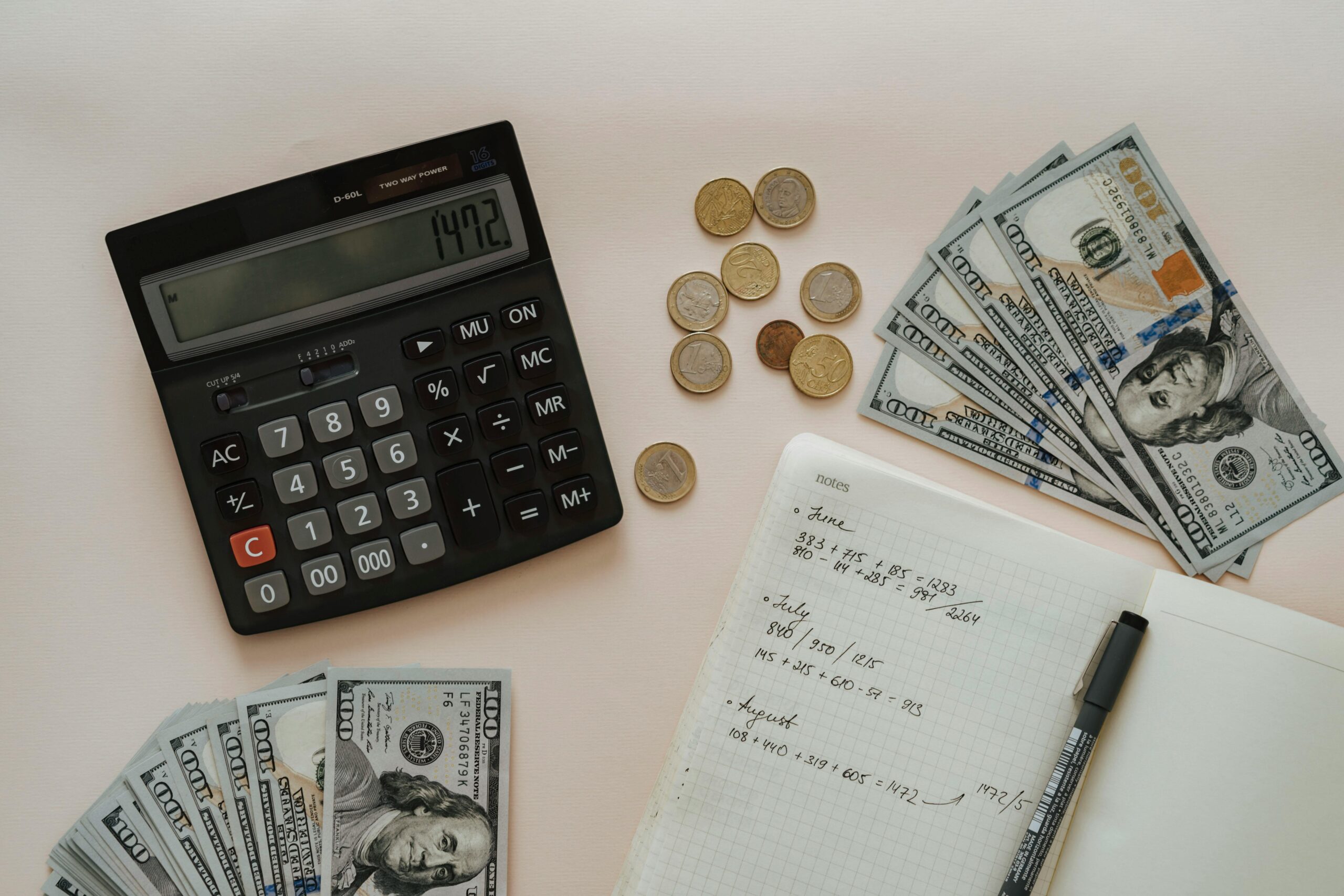

Begin by documenting your income and expenses to get a clear picture of your financial situation. This can be done using pen and paper, spreadsheets, or budgeting apps.

Distinguish between essential expenses (needs) and discretionary spending (wants). Focus on covering your needs first, then allocate funds towards your wants based on their importance and affordability.

Be honest with yourself about your spending habits and set realistic limits for each category of your budget. Remember, it’s okay to adjust your budget as needed, but strive to stick to your limits whenever possible.

Take the guesswork out of saving by setting up automatic transfers to your savings or investment accounts. This ensures that you’re consistently putting money aside towards your goals, even when life gets busy.

Review and Adjust Regularly:

Your budget isn’t set in stone. It’s important to regularly review your spending, track your progress toward your goals, and adjust your budget as needed to stay on track.

Tools for Budgeting Success

Conclusion

In conclusion, budgeting is not just about numbers; it’s about empowerment. By taking control of your finances through budgeting, you’re not only setting yourself up for financial success but also gaining peace of mind and the freedom to live life on your terms. So why wait? Start budgeting today and unlock the power to achieve your financial dreams!